What is Equity Release?

If you’re 55 or older and own a home, you could get tax-free cash from your property without having to move out or sell it. Learn all about equity release to understand how it works.

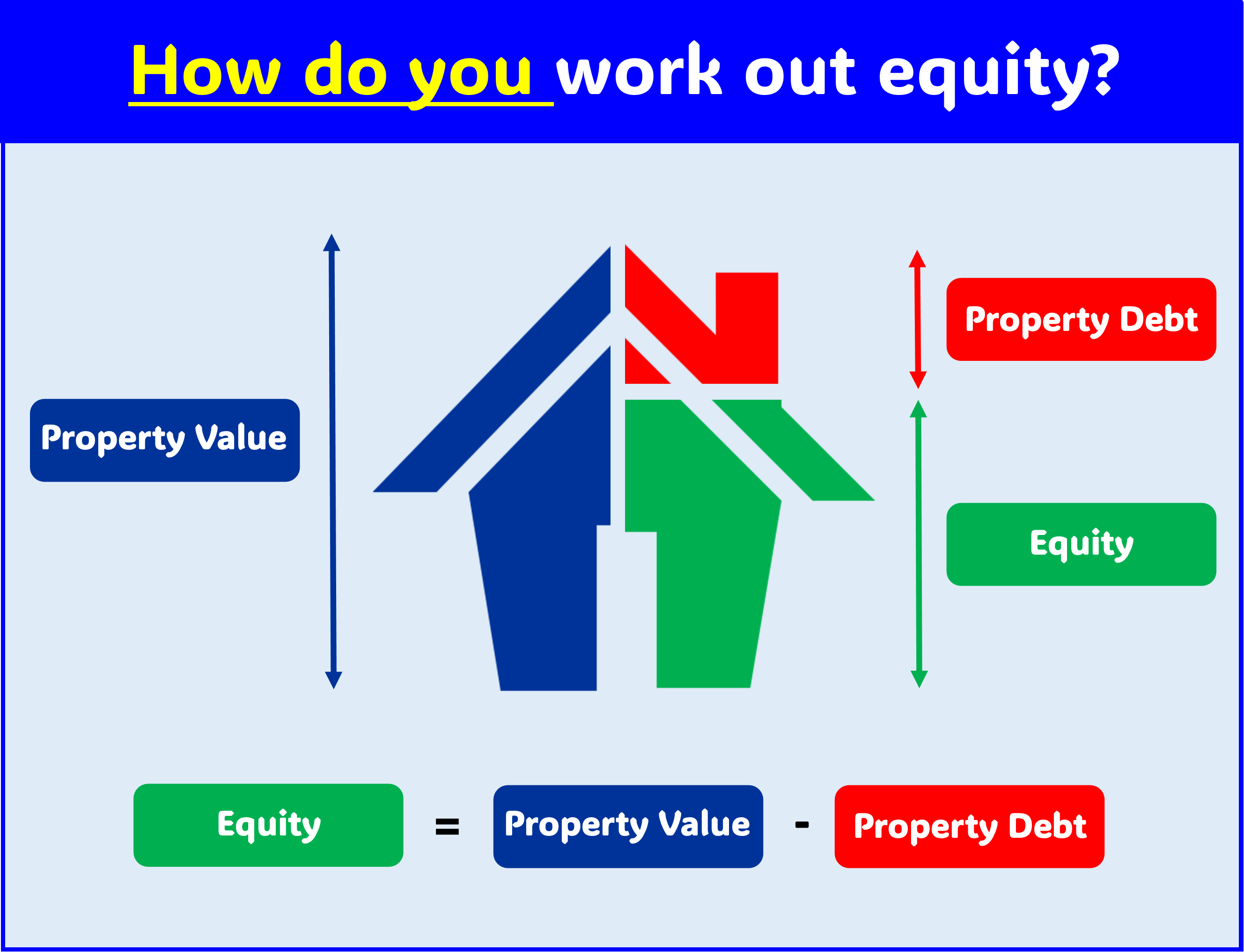

What is equity?

Equity is the portion of your home that you truly own. It’s the difference between the current market value of your property and any outstanding mortgage or loans you have against it.

For example, if your home is worth £200,000 and you still owe £50,000 on your mortgage, your equity is £150,000.

Essentially, equity represents the amount of money you would receive if you sold your home and paid off all your debts related to the property.

Equity Release Video

Watch the video below to see what Martin Lewis has to say about equity release on This Morning:

What are the two types of equity release available?

The two main equity release schemes are lifetime mortgages and home reversion plans. Both allow homeowners to access tax-free cash from the value of their property.

Lifetime mortgages

Lifetime mortgages are popular among those over 55 who want to access tax-free cash from their home’s value. A lifetime mortgage allows you to borrow money against your property without regular repayments.

The loan and any interest accrued are generally settled when the property is sold, typically after you pass away or move into long-term care.

Any money left over after repaying the loan and interest can then be passed on to your beneficiaries.

Some plans even allow you to ring-fence a portion of your property’s value to ensure an inheritance for your loved ones. You could get the money as a lump sum or in smaller instalments through a drawdown facility.

Additionally, there are options like interest-only lifetime mortgages, where you can make payments to prevent interest from accumulating, and enhanced lifetime mortgages that offer higher payouts or better rates for individuals with certain medical conditions or lifestyle factors.

Learn more about lifetime mortgages.

Home reversion plans

Another equity release option is a home reversion plan, in which you sell part or all of your home for tax-free cash.

This option allows homeowners aged 60 and above to access cash through a lump sum, regular income, or a combination of both without needing rent, loan repayments, or interest payments.

If you sell only a part of your home to the home reversion company, you retain ownership of the remaining share, which can be passed on to your beneficiaries.

This ensures that they receive an inheritance based on the future market value of their portion of the property.

Who can get Equity Release?

Eligibility for equity release is pretty strict; find out below if you meet the minimum requirements.

Your property

When it comes to using equity release, your property must be your primary residence, where you live consistently. You are not allowed to leave it unoccupied for more than six months at a stretch.

Your home’s value

Your property must usually be valued at £70,000 or more to qualify for a lifetime mortgage.

The type of home you have

While a freehold house is the typical property for a lifetime mortgage, other types, like leasehold properties like flats and apartments, may also qualify. However, eligibility might depend on factors like the length of the lease.

Some providers may reject certain styles of homes, like retirement apartments or properties with unique designs or materials. It’s wise to consult an adviser before applying.

Where your home is

To qualify for a lifetime mortgage, your property must be located within the UK, excluding the Isle of Man and the Channel Islands.

Any outstanding mortgage

Your property should ideally be mortgage-free or have a minimal remaining mortgage amount. Any existing mortgage must be paid off before applying for or using the released funds.

Your age

Applicants must be 55 or older (60 for Home Reversion), and joint applicants must meet this age requirement.

How much money you need

For a lifetime mortgage, the minimum borrowing amount is £10,000. The maximum amount you can borrow depends on your age and property value.

How much equity can you release?

The Equity Release Council’s market data sheds light on the amounts people release from their properties. For instance, the average equity release amount for customers opting for a lifetime mortgage in 2023 was around £97,878.

Your equity release provider considers several factors when deciding how much you can release:

Property Value

The amount available for release is based on a percentage of your property’s value. Providers often conduct property valuations during the application process.

Loan To Value (LTV)

If you qualify, the maximum you can unlock depends on your situation. Generally, you won’t get more than 50% of your home’s value. Equity release falls between 20% and 50% of the property’s value for most people.

Your equity

Besides the property’s value, your equity, calculated by subtracting any mortgage or debts secured against it, influences the amount you can release. For instance, if your home is worth £300,000 and the outstanding mortgage is £50,000, your equity is £250,000.

Type, location, and condition of your property

Lenders consider property condition, construction type, and location since a lifetime mortgage is repaid through property sale. Due to lender restrictions, non-standard properties may not be eligible for equity release.

Your age

The older you are, the more you can typically borrow with a lifetime mortgage:

- At 55, you may borrow around 20-25% of your property’s value.

- At 75+, you can release a larger share, up to 45% for those aged 75 and around 60% for older applicants.

- The lender bases release amounts on the youngest applicant’s age for joint applications.

Your health or lifestyle

Health issues can positively impact your release amount. Enhanced equity release allows for higher cash release or lower interest rates for specific health conditions or lifestyle choices, like smoking.

The extra release amount depends on condition severity or lifestyle specifics. An equity release adviser can guide you through health and lifestyle assessments and provide quotes for enhanced lifetime mortgages.

What can you spend the money on?

The money you release through equity release can be spent on anything that suits your needs or goals. Many people use the funds to improve their financial situation, whether by paying off existing debts or supplementing their retirement income.

Others may invest in home improvements, assist family members, or make significant purchases like a vehicle or a holiday. Some also use equity release as part of inheritance tax planning.

What are the pros and cons of a lifetime mortgage?

When considering a lifetime mortgage, weighing the advantages and disadvantages carefully is essential. Here’s a breakdown.

Pros

✔ Maintain ownership. With a lifetime mortgage, you retain full home ownership.

✔ Family protection. The no negative equity guarantee ensures your loved ones won’t inherit debt exceeding the property’s sale value.

✔ Inheritance. You can reserve a portion of your home’s value for inheritance, though it may reduce the amount you can borrow.

✔ Flexible access. Options include a lump sum or smaller cash reserves, with the ability to make partial repayments if desired.

✔ Portability. You can transfer the mortgage to a new home, provided it meets the lender’s criteria.

✔ Downsizing protection. If downsizing later, you might be able to repay the mortgage without penalty.

Cons

❌ Accrued interest. Interest accumulates rapidly on the total borrowed amount, potentially resulting in substantial repayments.

❌ Reduced inheritance. Repaying the borrowed sum, plus interest, diminishes the inheritance left for beneficiaries.

❌ Tax and benefit implications. Cash withdrawals could impact taxes and eligibility for certain benefits, necessitating advice from an equity release adviser.

❌ Long-term commitment. Lifetime mortgages are typically lifelong commitments, subject to significant early repayment charges if terminated early.

❌ Legal expenses. Legal advice is necessary, incurring additional costs for the borrower.

Is equity release safe?

Equity release products are generally considered safe, with organisations like the Equity Release Council (ERC) and the Financial Conduct Authority (FCA) overseeing the industry to ensure customer protection and fair treatment.

The Equity Release Council

Established in 1991, the Equity Release Council advocates for the responsible use of housing equity in later life.

Only deal with companies who are members of the ERC, they must adhere to their standards and guidelines, which include requiring applicants for lifetime mortgages to seek legal and financial advice.

ERC members follow safeguards such as ensuring your home remains yours for life, meaning you won’t be forced to move out during your lifetime.

Additionally, there’s a “no negative equity guarantee” ensuring that neither you nor your estate will owe more than the sale value of your home.

The Financial Conduct Authority

The FCA regulates equity release advisers and providers, ensuring they act ethically and protect customers’ financial well-being.

This regulation extends to interest rates, ensuring transparency and fairness in lending.

Ensure your adviser meets the following criteria:

- They search the entire market to find the right plan for you.

- They are listed on the Financial Conduct Authority register under their firm’s name. This ensures they are regulated and accountable, and they must be a member of the Financial Ombudsman Service for dispute resolution.

- They are a member of the Equity Release Council and listed in their directory. This guarantees they adhere to the Council’s strict Rules and Standards.

Before making a decision, ask your adviser about their fees, the types of equity release products they offer, and any additional costs you may incur, such as legal or valuation fees.

How much does it cost?

Lifetime mortgage interest rates usually start at around 5.5% but can go up to nearly 8%, notably higher than standard residential mortgages.

When deciding on the right equity release option, it’s essential to consider the potential impact of compound interest, especially if you choose not to make monthly repayments.

For example, borrowing £25,000 at age 65 with a 6% interest rate means your debt could double roughly every 12 years. By age 77, you might owe about £50,000, and by age 89, it could be as high as £100,000.

For an accurate look at compound interest, you can use our calculator.

Alongside the actual interest costs, various fees must be accounted for, typically ranging from £1,500 to £3,000. These fees cover arrangement, valuation, legal, and surveyor expenses, depending on the specific plan chosen.

How long does it take?

Once you’ve received financial advice, it typically takes around eight weeks from application to receiving your equity release funds, though it can vary.

Some applications speed through in as little as three weeks, while more complex ones can take months.

Regardless of the plan, the process generally follows these steps.

- Fill out the application form. You’ll need to complete an application form, often with pre-filled information from previous meetings. Your adviser will sign off on it, verifying their advice. They’ll also need your identification and proof of address.

- Submitting to the lender. Once complete, the form is sent to the lender, who arranges a property valuation.

- Property valuation. A surveyor assesses your property’s value, sometimes with a physical visit, sometimes remotely. This usually takes less than 30 minutes.

- Formal mortgage offer. Once the valuation report is in, the lender’s underwriters review it. If all goes well, they issue a formal mortgage offer within 48 hours.

- Legal advice. Your solicitor provides independent legal advice on the equity release and arranges for you to sign the mortgage deed. This process should take around one week.

- Requisitions. The lender’s solicitors may request more information, potentially delaying completion. This can take 1-2 weeks.

- Completion. Funds are transferred to you via your solicitor, typically within three days. While these are the main steps, many factors can affect timing, from property complications to incomplete paperwork. Discuss any deadlines with your adviser to ensure a smooth process tailored to your needs.

In addition to the main steps outlined, various factors can affect the timeline of an equity release application. Understanding these potential hurdles can help you anticipate delays and better navigate the process.

- Property sales and purchases. An ongoing sale or purchase of a property can complicate matters and delay the equity release process. Issues such as incomplete sales chains or legal complexities may arise, requiring additional time to resolve.

- Unregistered properties. Properties not registered with the Land Registry may encounter delays during application. Additional steps may be required to verify ownership and establish legal title, prolonging the timeline.

- Deceased owners on the title deeds. In cases where the title deeds include deceased owners, additional legal procedures may be necessary to transfer ownership rights. Resolving these matters can take time and may delay the equity release application process.

- Lease extensions. Properties with short lease terms may encounter challenges with equity release, as lenders typically prefer properties with longer leases. Extending or addressing lease-related issues may be necessary before proceeding with the application, leading to delays.

- Undisclosed information at the advice meeting. Failure to disclose relevant information during the initial advice meeting can result in delays later in the process. Providing accurate and comprehensive information from the outset is essential to avoid complications during the application process.

- Property down valuations. If the property’s valuation is lower than expected, it can impact the maximum amount that can be released through equity release. In such cases, lenders may require additional assessments or adjustments, delaying the application’s finalisation.

- Separation agreements. Properties subject to separation agreements or disputes between co-owners may face delays in the equity release process. Resolving these legal issues and obtaining consent from all parties can prolong the application timeline.

- Properties held in trust. Properties held in trust may require additional legal steps to release equity, as trustees must comply with specific legal requirements. Ensuring compliance with trust regulations and obtaining necessary approvals can extend the application process.

- Applying to the courts of protection. In cases where individuals lack mental capacity or cannot make financial decisions, applications to the courts of protection may be necessary to proceed with equity release. These legal proceedings can be complex and time-consuming, resulting in delays.

- CCJs, cautions, and restrictions on the title deeds. Existing legal encumbrances on the property, such as County Court Judgments (CCJs), cautions, or limitations, can complicate the equity release process. Resolving these issues and obtaining a clear title may require additional time and legal procedures.

By being aware of these potential challenges and discussing them with your adviser, you can proactively address any issues and minimise delays in the equity release application process.

Things you need to know about Equity Release

Equity release can offer a way to access extra funds without leaving your home, but it’s not without drawbacks. Here are some reasons why it might not be the best choice for everyone.

- Cost. Equity release can be more expensive than a regular mortgage. With a lifetime mortgage, you’ll typically face higher interest rates, and the interest can compound over time, increasing your debt.

- No fixed term. Lifetime mortgages usually don’t have a fixed repayment term. The interest rate remains constant throughout the contract, and any additional borrowing may have varying interest rates, potentially affecting your overall debt.

- Home valuation. Home reversion plans may not offer the total market value of your property since you’re allowed to remain in your home for life. This means you might receive less than if you sell your property on the open market.

- Future financial needs. Releasing equity from your home could limit your ability to use the property’s value for future financial needs, such as long-term care expenses.

- Downsizing challenges. While you can move home and transfer your lifetime mortgage, downsizing may not be feasible if you don’t have enough equity to cover the mortgage repayment.

- Impact on benefits. Receiving money from equity release could affect your eligibility for state benefits, potentially reducing your overall income.

- Arrangement fees. Equity release often involves arrangement fees ranging from £1,500 to £3,000 depending on the plan, adding to the overall cost.

- Inheritance. If you opt for an interest roll-up lifetime mortgage, there may be less to pass on to your family as inheritance, as the debt accumulates over time.

- Complexity. Equity release schemes can be intricate to unwind if you change your mind, requiring careful consideration and professional advice.

- Early repayment charges. Changing your mind about equity release may incur early repayment charges, although these are typically waived in the event of death or moving into long-term care.

- Impact on inheritance. Equity release can impact the inheritance you leave to your family members, potentially leading to conflicts or complications. Open communication with your family is crucial to address any concerns or expectations.

Considering these factors alongside your circumstances and financial goals is essential when evaluating whether equity release is the right option for you.

Remember, there are alternatives to equity release.

Find an adviser

Find a qualified and regulated equity release adviser using the Equity Release Council's register.

How much can you release?

You can usually release a minimum of £10,000, but the maximum amount varies based on several factors, such as your property's value and your age.

Typically, the older you are, the more you can release.

Are you looking for a quote?

While we do not provide a quote or call-back service as our website is purely informational, we understand that some people do want an equity release quote.

Get Started

To find out how to get the best equity release quote read our guide